Your Digital Vault: Understanding Crypto Wallets & The Critical Hot vs. Cold Choice

Forget leather billfolds stuffed with cash. In the digital asset revolution, your gateway to cryptocurrencies like Bitcoin and Ethereum is a crypto wallet. But unlike a physical wallet holding cash, a crypto wallet doesn’t actually “store” your coins. Understanding what it does do, and the crucial distinction between Hot Wallets and Cold Wallets, is fundamental to securing your digital fortune. This is your essential guide to crypto self-custody.

What a Crypto Wallet Really Is: Keys, Not Coins

- The Myth: “I send my Bitcoin to my wallet.”

- The Reality: Your cryptocurrency always lives on its respective blockchain – a vast, distributed public ledger. What a wallet actually manages are your cryptographic keys. These keys are the linchpin of security and ownership:

- Private Key: An immensely long, randomly generated string of letters and numbers. This is your supreme digital signature and proof of ownership. It mathematically proves you control the funds associated with your public address. Crucially: Whoever possesses the private key controls the crypto. Lose it? Lose access forever. Share it? Lose your funds.

- Public Key: Derived mathematically from the private key. It’s used to generate your wallet’s public address (like your account number) – the string you share to receive crypto.

- Seed Phrase (Recovery Phrase): Typically 12, 18, or 24 random words generated when you first set up your wallet. This phrase is a human-readable representation of your private key(s) and is the ultimate backup. Anyone with your seed phrase can regenerate your private keys and access your funds. Guard this with your life!

The Wallet’s Core Functions:

- Key Generation: Creates your unique cryptographic key pair.

- Key Storage: Securely stores your private keys (or the seed phrase to derive them).

- Address Management: Generates public addresses for receiving funds and tracks balances associated with those addresses by querying the blockchain.

- Transaction Signing: Uses your private key to cryptographically sign outgoing transactions, proving you authorize the transfer of funds from your address.

- Blockchain Interaction: Broadcasts signed transactions to the blockchain network and receives updates about incoming transactions.

The Great Divide: Hot Wallets vs. Cold Wallets

The defining characteristic separating wallet types is their connection to the internet. This connection directly impacts security, convenience, and use case

1. Hot Wallets: The Digital Spending Money

- Definition: A hot wallet is any crypto wallet that is connected to the internet.

- How They Work: Software applications (desktop, mobile, web-based) that store your private keys on an internet-connected device.

- Core Characteristics:

- Constant Connectivity: Always online.

- High Convenience: Easy and fast setup. Ideal for frequent transactions, trading, interacting with DeFi protocols, NFT marketplaces, or making crypto payments. Accessible anywhere with your device.

- Vulnerability: Being online makes them inherently more susceptible to remote hacking attempts:

- Malware/Keyloggers: Can steal keys if they infect your device.

- Phishing Attacks: Tricking you into revealing seed phrases or private keys.

- Exchange Hacks: If your hot wallet is hosted on a crypto exchange (a custodial wallet – see below), you rely on the exchange’s security, which has been breached many times.

- Types:

- Software Wallets: Apps on your phone (Trust Wallet, Exodus, MetaMask Mobile) or computer (Exodus, Electrum, MetaMask Browser Extension).

- Web Wallets: Accessed through a browser (like MetaMask in-browser, or wallets on exchange websites like Coinbase or Binance). Crucial Note: Exchange wallets are typically “custodial” – the exchange holds your keys.

- Browser Extension Wallets: MetaMask is the prime example, essential for interacting with Ethereum-based dApps.

- Best For: Smaller amounts you use actively for trading, spending, or interacting with dApps/DeFi. Think of it like the cash in your physical wallet – convenient for daily use, but you wouldn’t keep your life savings there

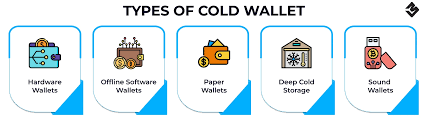

2. Cold Wallets: The Digital Fort Knox

- Definition: A cold wallet (or hardware wallet) is a physical electronic device specifically designed to store your private keys offline, completely disconnected from the internet.

- How They Work: Dedicated devices (like a USB stick, but far more secure) that generate and store your private keys within a secure element (a tamper-resistant chip). They never expose the private key to the internet, even when signing transactions.

- Transaction Signing Process:

- You create an unsigned transaction on your connected computer/phone.

- The transaction details are sent to the cold wallet device (via USB, Bluetooth, or QR code).

- You physically verify the transaction details (recipient address, amount) on the device’s screen.

- You physically approve the transaction on the device (usually by pressing a button).

- The device internally signs the transaction with your offline private key.

- The signed transaction is sent back to your computer/phone.

- Your computer/phone broadcasts the signed transaction to the blockchain.

- Transaction Signing Process:

- Core Characteristics:

- Air-Gapped Security: Keys are generated and stored offline. Immune to remote hackers and most malware (as long as you verify details on the device screen).

- Physical Confirmation: Requires manual verification and approval on the device itself, adding a critical layer of security against compromised computers.

- Enhanced Security: Considered the gold standard for securing significant crypto holdings long-term.

- Less Convenient: Requires the physical device to sign transactions. Setup is slightly more involved than a hot wallet. Not ideal for daily micro-transactions.

- Cost: Involves purchasing the physical hardware device (typically $50-$200).

- Examples: Ledger (Nano S Plus, Nano X), Trezor (Model T, Safe 3), KeepKey, BitBox02, Coldcard (Bitcoin-focused).

- Best For: Long-term storage of significant cryptocurrency holdings (“HODLing”), large investments, inheritance planning. Think of it like a bank vault or safe deposit box for your digital gold.

Hot vs. Cold Wallet Comparison: At a Glance

| Feature | Hot Wallet | Cold Wallet (Hardware Wallet) |

|---|---|---|

| Internet Connection | Always Connected | Offline (Air-Gapped) |

| Private Key Storage | On Internet-Connected Device (Phone/PC) | Secure Element Chip on Dedicated Device |

| Security Level | Lower (Vulnerable to online threats) | Highest (Immune to remote hacks) |

| Convenience | High (Quick access, easy transactions) | Lower (Requires physical device) |

| Cost | Free (Most software wallets) | $50 – $200+ (Hardware cost) |

| Best For | Active Use: Trading, Spending, DeFi, dApps | Secure Storage: Long-term holdings, large sums |

| Vulnerabilities | Malware, Phishing, Exchange Hacks, Device Loss/Theft | Physical Theft, Damage, Supply Chain Attacks*, User Error (losing seed) |

| Examples | MetaMask, Trust Wallet, Exodus, Coinbase App | Ledger Nano, Trezor, Ke |

*Supply Chain Attack: Rare risk where a compromised device is intercepted before you get it. Mitigated by buying direct from the manufacturer and initializing/resetting yourself.)

Custodial vs. Non-Custodial: Another Critical Layer

- Non-Custodial Wallets (True Self-Custody): You control your private keys (and seed phrase). This applies to most software wallets you install yourself and all hardware wallets. “Not your keys, not your crypto.”

- Custodial Wallets: A third party (like a cryptocurrency exchange: Coinbase, Binance, Kraken) holds your private keys on your behalf. You access funds via a username/password (like online banking). While convenient, you trust the custodian’s security and honesty. If they get hacked or go bankrupt, your funds could be at risk. Exchange wallets are a type of hot wallet, but custodia

Security Best Practices: Beyond Hot vs. Cold

- Seed Phrase is SACRED: Write it down by hand on durable material (metal backup is best). Never store it digitally (no photos, cloud, email, text files). Store multiple copies securely in different physical locations (e.g., safe deposit box, home safe). Never share it.

- Use Strong, Unique Passwords: Especially for hot wallets and exchange accounts. Enable 2FA (Two-Factor Authentication) using an authenticator app (like Google Authenticator or Authy), NOT SMS.

- Beware of Phishing: Double-check URLs, never click suspicious links in emails/DMs promising free crypto. Bookmark legitimate sites.

- Keep Software Updated: Update your wallet apps, device OS, and hardware wallet firmware regularly.

- Verify Addresses Meticulously: Always double-check the recipient address character-by-character before sending. Malware can swap addresses in your clipboard.

- Consider Multi-Sig: For very large holdings or shared accounts, use multi-signature wallets requiring multiple private keys to authorize a transaction.

The Hybrid Approach: Balancing Security & Convenience

Most savvy crypto users employ a combination:

- Cold Wallet: The “savings account.” Holds the majority of holdings long-term.

- Hot Wallet(s): The “checking account.” Holds a smaller amount for active trading, DeFi participation, or spending. Funds can be transferred from cold to hot as needed.

Empowering Your Financial Sovereignty

A crypto wallet is your passport to the decentralized financial world. Understanding that it manages keys, not coins, is the first step. The critical choice between hot and cold wallets boils down to the fundamental trade-off between convenience and security.

- Hot Wallets: Essential tools for active participation in the vibrant crypto ecosystem, but only suitable for amounts you can afford to lose due to online vulnerabilities. Practice extreme vigilance.

- Cold Wallets: The indispensable fortress for securing your valuable digital assets long-term. The upfront cost and minor inconvenience are negligible compared to the peace of mind they offer.

By choosing the right wallet type for each purpose, diligently safeguarding your seed phrase, and adhering to security best practices, you take full control of your financial destiny in the digital age. Remember, in cryptocurrency, security isn’t just an option; it’s the foundation of true ownership.